Monday, January 28, 2008

Book Review: The Ultimate Gift, The Prize

Red Stevens was a self-made man who gave his family everything -- and ruined them in the process. Now, as his estate of oil companies and cattle ranches is divided among greedy and self-serving relatives, one member is singled out for something special: Red's great-nephew, Jason.

In a darkened room, isolated from the rest of his family, Jason is confronted by the image of his deceased great uncle on a video monitor... and so begins a 12 month quest for purpose and meaning in an empty life, as Jason attempts to complete the tasks required to receive Red Stevens' greatest bequest....The Ultimate Gift. If your kids won’t read it, you can always see the movie

The Prize : The Epic Quest for Oil, Money & Power by Daniel Yergin

Although written in the early 90’s about the history of oil as an industrial product, it provides us a terrific understanding of the dynamics that shape the oil industry. A winner of the 1992 Pulitzer Prize for nonfiction, it is a comprehensive history of one of the commodities that powers the world--oil. Founded in the 19th century, the oil industry began producing kerosene for lamps and progressed to gasoline. Huge personal fortunes arose from it, and whole nations sprung out of the power politics of the oil wells. Yergin's fascinating account sweeps from early robber barons like John D. Rockefeller, to the oil crisis of the 1970s, through to the Gulf War.

Oil Over $100! This May Be Just What the Doctor Ordered

Since President Bush came to office, the price of oil has increased nearly 4 times. An enormous transfer of wealth has occurred during this period. The value of hydrocarbon exports from the Middle East and Asia is expected to be $750 billion in 2008. The Abu Dhabi Investment Authority, the government investment company for the United Arab Emirates, now has over $900 billion in assets and recently lent Citibank $7.5 billion with the right to purchase just under 5% of the equity shares. Other state owned Arab Emirates now own large stakes in the NASDAQ and the London stock exchange as well as other prized assets around the globe.

So how does the price of oil going over $100 help the US? It will increase the innovation in our country to find alternative sources of fuel. It will also increase our desire to purchase more fuel efficient products and ultimately it will reduce the US emissions of CO2 gas. Hopefully, future generations will look back at the “oil age” as just a short 200 year blip of time.

Children and Money: Instill the Value of a Dollar at an Early Age

I last wrote about this subject in my 3rd quarter 2006 Financial Forum and received some very favorable feedback. In that article, I listed 10 ways to help teach children about money. Over the past two years, I have tried very hard to implement these steps and now feel it appropriate to write a condensed version in case some of you are struggling to teach your children ten steps about something as abstract as money and would prefer to start with just two. By the way, if you do not have children or if they have already moved out of the house, you can still apply these to yourself or your grown children. Like everything else with kids and adults, if you stick with it long enough, it will stick. If you did not get a chance to read the original article, just send me an email and I will forward it to you.

1. Form a Habit of Savings

When my son was about eight, we broke open his piggy bank, drove down to our bank and opened a savings account with the money he had saved. The process was a lot of fun and a great learning experience. He learned about interest, savings and balancing his account on a monthly basis. Each month he added a little of his working allowance and his gift money to the account. The account has grown to about $2,000, which is a lot of money for an eleven year old.

Recently, he started complaining about the amount of interest he is earning on the account. I suggested he take the money out of the bank and buy a stock or mutual fund with the possibility of earning more on his investment. We have had many discussions on the merits of Starbucks, Quicksilver and other public companies he was familiar with. He was not too happy to learn that stocks can go up and down sometimes rather drastically. However, it gave us the opportunity to talk about investing in general and about risk. Because he had saved the money himself, it really mattered to him that he not lose it on a speculative investment. I was willing to let him invest in whatever he wanted as long as he understood the risks relating to the investment.

After discussing the options, he finally said that I had a very boring job and that since I did this for a living, I should decide. I was happy to see that my brilliant son had the presence of mind to outsource his investment selection process. We decided to close the account and move the $2,000 he accumulated to two ETF funds (SPY and EMM). While this may seem very basic, it has been a very powerful experience for both of us. My son learned several important facets about money. He learned the value of saving, working for money, compounded interest, investing, and risk.

My daughter will be a new challenge. She is not as materially oriented as my son and as of yet, sees no real use for money. I will update you on our progress in a few years!

2. Create an Abundance Mentality with Regards to Money

Most people grow up with the perception that money is a limited resource that is only readily available to a few lucky people. They spend their lives chained to this concept, which keeps them forever a victim of money. Having an abundance mentality about money is a self fulfilling prophecy. It comes from these two principals:

Money flows to the greatest perceived value.

The less you need, the more you have.

Money flows to the greatest perceived value

Let’s review the first one from an adult perspective and then break down to the kid level. Take two attorneys, for example, that both focus on small business owners. One makes about $150,000 per year and one makes about $3 million per year. Why does one get 20 times the income of the other? The one who gets 20 times the income creates 20 times the value for her clients. One is focused on hourly billing, while the other is focused on the success of her client. This concept is focused on in Nassim Nicholas Taleb’s book, The Black Swan: The Impact of the Highly Improbable

Now, let’s look at it from your child’s perspective. Apprehension about college and job selection begins as early as age 16. As I have already said, my children find my job boring and thus will most likely pursue some other career. The teaching opportunity is not to focus your child on the jobs that pay the most, but on creating the greatest value in a job they will love. “Talk about what is of interest to them and how important it is to be happy with what you do,” says Dr. Jaye Roseborough, a director of career services for a small university in Vermont. In order to create extraordinary value in your career, you must be truly passionate about what you are doing. You cannot do this if you are pushed by your parents into a career you do not love. Examples of creating incredible abundance through creating tremendous value include Oprah Winfrey, Bill Gates, Chef Michel Richard, Lance Armstrong and thousands more.

The Less You Need the More You Have

Separating your needs from your wants is a powerful distinction I learned from my father at a very young age. Most children and adults have a never ending list of “needs” that drives them to immediate gratification with an endless supply of junk. In reality, 99% of these “needs” are really “wants”! “Needs” are things like food, shelter and medical care. “Wants” are everything else. Once we make this distinction, we can choose whether or not to make the purchase. If we can make this shift, the new “need” becomes the savings or investment account rather than the latest electronic gadget. One of the quickest ways to implement this distinction with your children is to ask them to pay for what they “want” with their own money. It is absolutely amazing to me how quickly the drop in desire is for this particular “want”. When they really want something, they will work hard to get it. This also instills the concept of delayed gratification which is an extremely healthy way of life. If you are having trouble with this concept, read the Dalai Lama’s The Art of Happiness.

Wednesday, January 2, 2008

Book Review: JFK

Let Every Nation Know: John F. Kennedy in His Own Words

by Robert Dallek, Terry Golway

I really enjoyed listening to Kennedy’s great speeches and then reading the analysis and history behind them. This is a quick read that will provide you with some history review and inspiration. Here is a review from Publishers Weekly:

After Lincoln, John F. Kennedy is generally acknowledged as our most eloquent president. The words of such major speeches as his inaugural and his remarks at the Berlin Wall resonate still in the minds of Americans. But as this book and CD illustrate, Kennedy was equally articulate on a host of other occasions, including campaign debates with Richard Nixon, White House press conferences, commencement addresses and comments on such topics as the integration of the University of Mississippi and the Cuban missile crisis.

Of course, a large part of JFK's communicative excellence lay in his smart, confident delivery. Thus bestselling Kennedy biographer Dallek and Golway (The Irish in America) present the speeches on a CD featuring Kennedy's own voice, while their book sets each of the CD's 32 tracks in historical context. The speeches and commentary trace JFK's presidential career from the 1960 campaign through his death. Painstakingly, the authors lay out the parameters of real politics that lay behind particular phrases and positions. In the end, the reader/listener is even more impressed with JFK after learning the backgrounds and contexts and then hearing Kennedy so lucidly express the words. (Apr.)

Copyright © Reed Business Information, a division of Reed Elsevier Inc. All rights reserved.

Monday, October 29, 2007

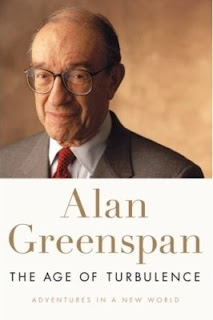

Book Review: The Age of Turbulence

In September, I was fortunate enough to see one of my favorite people live at my graduate school alma mater George Washington University’s Lisner Auditorium. The “Maestro”, Alan Greenspan, was promoting his new book, The Age of Turbulence. At 81, Greenspan is hardly in need of money to support his modest lifestyle. However, having been virtually silent for the past 18 years at the Federal Reserve, he is literally bursting to express his opinions, both political and economic, as well as providing us with some insight and history for future generations. I believe this book, and the controversy surrounding it, may have a significant positive impact on the future economic success of the US economy.

Greenspan explained that the Fed was weaker today than in years past due to the “global forces” beyond its control. These “forces” are part of the “Conundrum” mentioned in one of his famous speeches about the Fed’s inability to affect long-term interest rates in 2004. In a light moment during his speech, Greenspan said he received over 10 bottles of the famous Caymus Conundrum wine. When asked how it was, he said he never touched it because of the name, “Conundrum, by its very nature is unknown. Why would I want to drink that?” he explained.

Greenspan, often referred to as a Right Wing Libertarian Republican, took the time to correct this mistake. “I am not right wing. [I am] far from it.” He explained how he felt that the Republican Party has moved too far away from its fiscally conservative roots, and how this shift allowed the Democrats to take control the house in 2006 and possibly the presidency in 2008. There are many other political issues mentioned in his speech and in the book, including issues relating to Greenspan’s disappointment with the Bush administration and his admiration for Mr. Clinton’s fiscal restraint.

What keeps the Maestro up at night? He mentioned 5 topics:

- US dependence on oil

- The growing U.S. deficit

- Lack of government funding for future Medicare requirements

- Inequity of income in the US

- The need to clarify the rules of intellectual property.

Greenspan was reluctant to talk about current Fed actions and the short term outlook for the economy. When pressed, Greenspan jokingly offered a highly precise a prediction of 42.5% chance of recession, up from the 30% chance he predicted in February.

Real Estate Corner: Catch a Falling Knife? Not Yet...

I purchased my first home, a townhouse near Fair Oaks Hospital, in Fairfax, VA in October of 1989. My timing was impeccable. When I compared it to the Index, the value of Washington single family homes was at an all time high. The Index peaked just 4 months later before falling like a rock until it reached the bottom in February of 1992. It was at this point I abruptly sold the house at the bottom of the market. According to the index value my home should have dropped about 5%. In reality, the property had dropped 10% and after selling commissions I owed more than it was worth.

The 10% I had put down was gone and I was now underwater by about $10,000. The index, which peaked in the Washington area in April of 1990, did not reach that peak again until February of 1999, nearly 10 years later.

I was recently in Tampa, Florida visiting a client when the S&P 500/Case-Schiller Home Price Index for July of 2007 was released. The report showed that the worst real estate markets in the country were Detroit, Tampa, and Washington. I asked my client about the local market to check to see if this rang true. He told me about two completed condo projects with no owners and one large condo project with just one family living in it. The scariest thing about this is that the Index does not include condos!!!!

Most people consider the value of their homes to be whatever the highest value ever paid in the neighborhood. Nationwide, I believe home prices have now moved down to their October 2005 values. In Washington, these values are down to the May 2005 values. The index shows a drop of 4% year over year nationally and a drop of 7.2% in the Washington MSA.

In my April 2005 Newsletter, I predicted a 10% market drop nationwide. It appears as of July of this year, we are nearly halfway there on a national basis and 75% there in the Washington MSA. Let’s take a look at the housing data to see just how bad it might get. Most of this data comes from Greg Weldon’s website http://www.weldononline.com/ and John Mouldin’s Weekly E-Letter.

Existing home inventories have increased by more than 1,000,000 homes since March 2007 and have doubled since 2005. In January of this year, there was a supply of homes for sale of about 6.6 months on the market. This figure has moved up to 10 months. There are now over 500,000 homes in the process of foreclosure and this number is increasing at an alarming rate. New home sales in August saw the largest decline in 30 years. Mean new home prices are down 11% in the last five months. Expensive homes, those above $750,000 are down over 35% from last year.

Many of the loan products, which helped people buy homes the last few years, are now gone. This includes not only sub-prime and Alt-A loan products, but the every day jumbo variety as well. The impact of this mortgage credit crunch will not be felt until the forth quarter of this year. As a result, I still believe we have a significant drop ahead. Washington MSA may experience a 15% drop from the 2006 high; nationwide I am still sticking to my 10% drop prediction.

While this may seem bearish, the market will bounce back. There will be some terrific buying opportunities in 2008. A significant amount of patience, however, will be required.

Asset Allocation: Going Green

How can you make a positive impact on the environment and capitalize on the “green” phenomenon?

Take Steps Towards Becoming Carbon Neutral

The concept of becoming carbon neutral can be debated by many as is global warming in general. However, for the purpose of this article, I will assume we all want to make a positive impact on our environment. You can start by taking steps to move your household towards carbon neutrality. I took the test at http://www.carboncounter.com/ and learned that I generated 4 times the carbon of the average US citizen! Thus, according to the calculations on the web site, I need to donate $576 to “offset” my carbon emissions and become “carbon neutral”. The donation goes to the Climate Trust, a 501 (c) (3) working towards a more stable climate.

According to the website, offsets are used to:

- Increase energy efficiency in buildings, factories, or transportation,

- Generate electricity from renewables such as wind or solar,

- Modify a power plant or factory to use fuels,

- Put wasted energy to work via cogeneration,

- Capture carbon dioxide in forests and agricultural soils.

Practice Energy Efficiency

Next time you buy a new appliance, remodel your home or buy a new one, factor energy efficiency into your decision-making process. According to the US Green Building Council, http://www.usgbc.org/, 10% of all carbon dioxide emissions in the country come from our homes. Typical American homes lack energy-efficient appliances, windows and insulation, thus consume extra energy to compensate for loss of heat and air conditioning. The up front costs of improvements will be recouped in the long run.

Recycle and Buy Recycled Products

Most people today recycle bottles, plastic and newspapers in their homes. However, few of us use recycled products. Using recycled materials, especially if they are locally made, can have a huge impact on the environment. Many of today’s building materials come from recycled waste. If you are in the Washington area, check out Eco-Green Living. Eco-Green Living, is the premier green, organic, and fair trade store in the Washington, D.C. metro region for lifestyle, home remodeling, and personal care products. You can find out more at http://www.eco-greenliving.com/

Invest in “Green” technology

The following is a list of funds that invest in various forms of “Green” technologies:

PowerShares Water Resources Fund (PHO) is based on the Palisades Water Index™. This Index seeks to identify a group of companies that focus on the provision of potable water, the treatment of water, and the technology and services that are directly related to water consumption.

PowerShares Global Water Fund (PIO) is based on the Palisades Global Water Index™. This Index seeks to identify a group of global companies that focus on the provision of potable water, the treatment of water and the technology and services that are directly related to global water consumption.

PowerShares Global Clean Energy Fund (PBD) is based on the WilderHill New Energy Global Innovation Index. The Index seeks to deliver capital appreciation and is composed of companies that focus on greener and generally renewable sources of energy and technologies facilitating cleaner energy.

PowerShares WilderHill Clean Energy Portfolio (PBW) seeks to replicate, before fees and expenses, the WilderHill Clean Energy Index, which is designed to deliver capital appreciation through the selection of companies that focus on greener and generally renewable sources of energy and technologies that facilitate cleaner energy.

PowerShares WilderHill Progressive Energy Portfolio Fund (PUW) is based on the WilderHill Progressive Energy Index. The Index is comprised of U.S.-listed companies that are significantly involved in transitional energy bridge technologies, with an emphasis on improving the use of fossil fuels.

The Spectra Green Fund (SPEGX) is a mutual fund that seeks long-term capital appreciation by investing at least 80% of its net assets in equity securities of companies of any size that, in the opinion of the Fund's management, conduct their business in an environmentally sustainable manner, while demonstrating promising growth potential.

By doing your part in the “Green” movement, you can feel good about the choices you make for a better world for you and your children.

Thursday, October 11, 2007

Book Review: The 4-Hour Work Week

Tuesday, October 2, 2007

Sector Performance Report 9/30/07

Saturday, September 29, 2007

Bad Economic News…Good for the Stock Market?!

The S&P 500 was up 1.6% for the third quarter and 7.6% (excluding dividends) year-to-date. International markets, as measured by the MSCI EAFE Index, were basically flat for the third quarter and are up 10.9% year-to-date.

Here is the good news; the futures market has currently priced in two more Fed cuts by the end of the year. This would leave the WSJ Prime Rate, currently at 7.75%, somewhere around 7% at the close of the year.

Pre-election Years May be Good for the U.S. Stock Markets

Since 1950, pre-election years like 2007 have produced an average return in the S&P 500 in excess of 19%. Thus we may be looking at a positive 4th quarter, even with a potential recession looming in 2008.

Now the bad news; inflation fears spooked the bond markets causing long-term rates to rise and the dollar to fall. According to economist John Mouldin, “The last three times the Fed initiated a new easing cycle, 10 year bond yields dropped 20 basis points or more in the next five days. This time they rose 20 basis points. Since mortgage rates are typically geared off the yield of the ten year Treasury bond, this is a cut that has not helped the consumer as of yet.”

Monday, June 11, 2007

Book Review: The Support Economy

Thursday, June 7, 2007

Retirement Matters: Is Your 401(k) Working For You?

Eighty percent of our retirement income will come from our savings in retirement plans and other after tax savings accounts. The bulk of this money will come directly or indirectly from employer sponsored 401 (k) accounts. However, most Americans pay little attention to this most important portion of savings. Many of us are guilty of spending very little time analyzing our 401 (k) investment allocations and fund selections, very few people actually review the plan costs with their sponsors and some do not even attempt to maximize their contributions to the plan. As participants in any retirement plan, you have the right to have quality investment selections in nearly every asset class at a reasonable cost.

Your 401(k) can be one of the best investments you will ever make. And if your employer is matching, it is a real “no brainer” When an employer offers 401k matching, they are guaranteeing that they will match a certain percentage of your contributions. A common match is 50 cents on the dollar. That means if you put one dollar into your 401k plan, they will match your contribution by putting 50 cents in. You just made 50% on your investment!

Now you see why it is important to maximize your contributions. The 2007 maximum contribution is $15,500 and if you are age 50 or older, you can make an additional catch up contribution of $5,000. Perhaps one of the biggest mistakes investors make is to pull back on their 401 (k) contributions because the market or their portfolio is doing poorly. However, every time the investor puts money into their 401(k), they are making a guaranteed profit up front. Besides, when the market goes down, most investors benefit because you begin buying assets at a lower cost!

I must disclose one important detail about this wonderful investment: Some companies do not have quality investment selections, while others do not have the appropriate asset classes covered. As an example, Fidelity 401(k)s are limited to mediocre funds (most have new managers) in a single fund family. And there are some plans and investment vehicles that charge very expensive fees to participate. If you fall under any of these, talk to your Plan Administrator and ask them to look into new plan options. They have a fiduciary requirement to provide you with quality plan investments at a reasonable price.

1st Portfolio, Inc. offers a retirement plan consulting service designed to bring professional, unbiased plan consulting combined with competent objective investment advice to the trustees and the participants of the plan.

Thursday, May 10, 2007

Book Review: Leadership

I read this book back in 2002, but decided to pull it out again in light of the 2008 presidential elections. It makes for an excellent read from a historical perspective and also provides some insight on the author. -MR

From Publishers WeeklyNew York's celebrated former mayor explains how he used specific management strategies to run the city and handle crises in this captivating memoir. Giuliani's minute-by-

minute account of his actions on September 11-trying to coordinate rescue efforts and reassure the populace while reeling from the deaths of firefighter friends he'd spoken to just minutes before-is harrowing. Other anecdotes are equally forceful, as when Yasser Arafat arrived uninvited to Giuliani's U.N. anniversary celebration, and Giuliani insisted on making Arafat leave while attempting to avoid an international scandal. Giuliani's main advice to leaders: surround oneself with talented people, hold daily meetings to keep everyone on track, define the core mission and make sure procedures and policies serve that mission efficiently, demand accountability from everyone (including oneself), show loyalty to employees and become knowledgeable about all subjects related to one's organization or business.

minute account of his actions on September 11-trying to coordinate rescue efforts and reassure the populace while reeling from the deaths of firefighter friends he'd spoken to just minutes before-is harrowing. Other anecdotes are equally forceful, as when Yasser Arafat arrived uninvited to Giuliani's U.N. anniversary celebration, and Giuliani insisted on making Arafat leave while attempting to avoid an international scandal. Giuliani's main advice to leaders: surround oneself with talented people, hold daily meetings to keep everyone on track, define the core mission and make sure procedures and policies serve that mission efficiently, demand accountability from everyone (including oneself), show loyalty to employees and become knowledgeable about all subjects related to one's organization or business.Monday, May 7, 2007

Federal Reserve Update

The strong employment report in early April seems to confirm the Fed’s inflation wariness and subsequent to the release of the minutes the likelihood of a Fed rate cut occurring declined significantly in the future’s markets. Currently, economists are debating as to whether the economy is in a mid-cycle slowdown or on its way to recession. The current market volatility is caused by this uncertainty. Stocks typically do well during mid-cycle slowdowns (which we are at the very least experiencing now), as a refreshing pullback in demand relaxes inflation pressures and allows for lower interest rates. However, history shows us that stocks don't fare so well if the economy doesn’t just slow down, but actually contracts.

Sunday, May 6, 2007

Estate Tax Summary

Current tax laws concerning federal estate taxes provide an applicable exclusion amount of $2,000,000 per person. Don’t forget about your life insurance policy! This means that each person can give away during life up to $1,000,000.00 or at death a combined total of $2,000,000.00 worth of property, without any taxes being due and payable.

On May 26, 2001, Congress passed “The Economic Growth and Tax Relief Reconciliation Act of 2001,” which provides for the applicable exclusion amount to increase over time as follows:

Additionally, current federal tax law provides for an unlimited marital deduction. This means that you may transfer an unlimited amount of property between you and your spouse without incurring any federal estate taxes. Combining the applicable exclusion amount with the unlimited marital deduction means that a married couple can have a combined estate of $4,000,000.00, which passes tax-free at the death of the second spouse. The tax rate on any amount in excess of $4,000,000.00 starts at forty-six percent (46%). To ensure utilization of the $2,000,000.00 applicable exclusion amount, both of you should have property worth at least $2,000,000.00 held in your own names or revocable trusts and not with rights of survivorship.

death, the principal is payable to the children outright or in continuing trust, free of any estate tax even on the appreciation of the assets in the credit shelter trust. The balance of the estate in excess of $2,000,000.00 is given outright to the surviving spouse and the surviving spouse, at his or her election, may place this additional inherited amount into his or her own revocable trust. Alternatively, the balance may be held in further trust. Upon the death of the surviving spouse, all of the survivor’s property is passed on to the children, either outright or in a continuing trust. The $2,000,000.00 in the bypass trust created upon the first spouse’s death, together with all appreciation therein, is not taxable again in the surviving spouse’s estate.

Sunday, April 8, 2007

Warren Buffet on International Investing

Each year I look forward to reading Warren Buffet’s annual report to the shareholders of Berkshire Hathaway. The 76 year old Buffet is the Chairman of Berkshire Hathaway, a holding company that owns a diverse group of subsidiaries.

With an estimated net worth of $28 billion, Buffet is one of the ten richest men in the world and considered by many to be the best investment analyst ever. In the past, he has stuck primarily with US investments, but as he says in his report to shareholders, things are changing.

In reference to the $2.2 billion dollars he made on currency exchanges and the nearly $3 billion earned on his investment in PetroChina, Buffet said, “As our U.S. trade problems worsen, the probability that the dollar will weaken over time continues to be high. . . the U.S. had $.76 trillion of pseudo-trade last year - imports for which we exchanged no goods or services (only money).” By doing this, Buffet said, “the US necessarily transferred ownership of its assets or IOUs to the rest of the world. Like a very wealthy, but self-indulgent family, we peeled off a bit of what we owned in order to consume more than we produced.”

Buffet continued, ”The ‘investment income’ account of our country – positive in every year since 1915 – turned negative in 2006. Foreigners now earn more on their U.S. investments than we do on our investments  abroad. In effect, we’ve used up our bank account and turned to our credit card.

abroad. In effect, we’ve used up our bank account and turned to our credit card.

The world’s best companies continue to make huge investments outside the U.S. We must follow their example and do the same. Over the past 5 years, the EAFE Index, has had an annualized compounded return of 16% compared to a return of just 7% for the S & P 500. A balanced investment portfolio must include a heavy dose of non-U.S. investments.

Buffet summarized his thoughts on this issue by stating, “It won’t be pleasant to work part of each day to pay for the over-consumption of your ancestors. I believe that at some point in the future, U.S. workers and voters will find this annual “tribute” so onerous that their will be a severe political backlash. How that will play out in the markets is impossible to predict – but to expect a “soft landing” is wishful thinking.”

Sunday, April 1, 2007

Sector Performance Report 3-31-07

Market Summary

Going forward, the market is likely to remain quite choppy. The housing market slowdown, which may be worsened by the growing debacle in the sub-prime mortgage market and tighter lending standards, is of chief concern to the market. Warnings by homebuilders and new federal investigations into lending practices have the market on edge as do concerns that these problems may spread into the broader economy. Further, a spike in oil prices amid growing Iranian tensions is adding fuel to the fire. These inflationary pressures are likely to keep the Federal Reserve in limbo in the short run but may allow for a drop in rates by the end of the year.

Volatility in the market creates ideal conditions for portfolio rebalancing. Make sure you do not have all your eggs in one basket or you may find yourself in the hole!